Every day, we are becoming more and more familiar with 5G. The technology, which only a year ago was just beginning to be deployed as a promising novelty – an opportunity to open a Pandora’s box of new innovations, applications and businesses –, is now on everybody’s lips at “coffee talks” to plan what to do in our new, fully connected world.

When we think about how 5G could reshape this world, our thoughts might fall on ultra-Reliable Low-Latency Communications (uRLLC) and what they can bring us – applications such as smart transportation, autonomous driving, remote healthcare and industrial automation.

When we talk about IoT and massive Machine-Type Communications (mMTC), we see huge numbers of connected devices constantly interacting with each other in a grid of elements that requires deep extensive coverage for everything to work together. However, in the consumer’s mind, 5G is still very much associated with the concept of fast data communications, i.e., enhanced Mobile Broadband (eMBB) – a technology that allows large amounts of data to be consumed while talking, for streaming contexts, interactive gaming, social media, remote working, or even to enjoy A/VR adventures at levels never achieved before, to name but a few.

Thanks to 5G, all these “dreams” could become a reality in the not-so-distant future. Indeed, 5G technology not only offers a theoretical data speed that is 20 times faster than its predecessor LTE, it can also dramatically reduce latency to below 1ms – to deliver previously unimaginable real-time experiences. This achievement is possible due to various technological reasons, of which undoubtedly the most important is the large channel bandwidth granted to 5G. With up to 400 MHz, it is 20 times wider than the 20 MHz allotted to LTE to date. But the wider the channel bandwidth, the wider the usable frequency spectrum, which leads to the question: where does all this spectrum come from?

The Third Generation Partnership Program (3GPP) is the body responsible for regulating cellular communications since 3G. In Release 15 of the 3GPP standards, two operating frequency ranges were defined:

- Frequency Range 1 (FR1), for Sub-6 GHz spectrum, including frequencies from 410 MHz to 6 GHz – almost all these frequencies are currently used by LTE.

- Frequency Range 2 (FR2), the so called “mmWave”, to cover the spectrum from 24.25 to 52.6 GHz – this is a new wide spectrum that enables massive network capacity.

Release 17 will further extend the frequency range to 71 GHz (up from 52.6 GHz), providing even more spectrum for Mobile Network operators (MNOs) to use. This could mean more opportunities to aggregate channels and increase bandwidth and therefore data speed.

The first 5G deployments, however, have focused on the Sub-6 GHz range, in particular the C-Band around 3.5 GHz, as most of it is already available. But this spectrum, which overlaps with LTE’s band, is to some extent still very limited and will eventually “run out” because of the increasing number of 5G use cases and users – so there is not much advantage to be gained from the wide 400 MHz 5G channel.

Therefore, mmWave will be the answer to the new demands for additional speed and capacity. In fact, FR2 is the only way MNOs can guarantee delivery of compelling eMBB services, making mmWave the real asset of 5G technology.

Current mmWave deployment

Few countries have taken initial steps towards deploying 5G in the higher frequency spectrum, and it’s a slow process for various reasons. mmWave brings several technological challenges that make Operators, infrastructure vendors and end-user manufacturers reluctant to invest in it, and which are intrinsically inherited from the wavelength nature and propagation conditions at high frequencies.

Operators need to redefine network planning – since any barrier between the transmitter and receiver (whether a wall, glass, trees or even foliage) can cause the signal strength to drop dramatically, and also impact propagation, thereby creating a clear issue, especially for reaching indoors. Base stations and CPE terminals will therefore be positioned in line-of-sight (LOS), propelling CPE manufacturers to design outdoor elements and convey/cabling the connectivity within the building.

And what about when the receiver (e.g., smartphone) is moving? Once more, infrastructure vendors and device manufacturers are creatively addressing this issue by turning mmWave’s short wavelength into an advantage. Indeed, the use of tiny antennas helps with beam forming and beam tracking to enhance coverage and spectral efficiency. In addition, by leveraging path diversity, beam steering and reflections, mmWave can also become a good solution for both indoors – where the propagation characteristics help avoid inter-cell interference – and for more robust mobility applications and terminals.

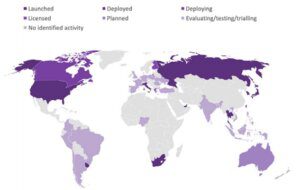

Skepticism is therefore gradually being overcome by the economic benefits and Return on Investment (ROI) that mmWave can bring to the economy, and deployments are indeed coming. According to the GSA, 106 MNOs (mobile network operators) spread across 20 countries own licenses to enable 5G networks in the mmWave spectrum, with 24 of them already deploying the technology for commercial use.

The US market, pushed by the Federal Communications Commission (FCC), is a step ahead of the rest of the world when it comes to the mmWave spectrum, with all major Operators now offering commercial 5G services in FR2 bands.

On the other side of the world, China has yet to make the mmWave spectrum available for commercial use. In Europe, while the initial focus for 5G commercialization was also on the C-band (despite its coexistence with LTE), there are now significant investments in mmWave, and this trend is likely to accelerate in the future. Italy, Finland and Russia are currently driving deployment and commercialization of 5G in the mmWave range.

Source GSA: Use of 5G spectrum between 24.25 and 29.5 GHz.

The good (and most important) news is that the market is getting ready for consumers, which demonstrates the commercial viability of the spectrum above 24 GHz. The industry foresees that by 2021, more than 100 mmWave handsets and more than 50 mmWave FWA CPEs will be available in the world market. Some of these devices will come with massive multiple-input multiple-output (M-MIMO) solutions to handle terminals moving at speeds of up to 100 Km/h.

mmWave momentum

While we wait for the regulators to free up the necessary amount of spectrum around the world, the Industry is not sitting still, having already invested significantly to benefit from the asset that mmWave provides as an essential component of the 5G system.

The opportunities for mmWave devices are huge. Deploying Fixed Wireless Access (FWA) in dense urban areas is just the first use case. Indeed, consider what it might mean to bring mmWave indoors, and how this could address the exploding demand of fiber-like wireless broadband access in crowded closed venues like auditoriums, convention centers and stadiums. 5G will not only improve speed and capacity in these places, it will also deliver lower latency and, most importantly, quality of service (QoS) – something that traditional Wi-Fi (being deployed in unlicensed bands) is struggling with.

mmWave’s momentum is now! MNOs, infrastructure vendors, manufacturers, and the entire ecosystem will scale its adoption based primarily on spectrum availability and reliable, cost-effective infrastructures and network offerings, but also, and equally important, on the commercialization of various end-user devices capable of sustaining both business and consumer markets.

Teldat has been leading the deployment of 5G routers and CPEs in the Sub-6 GHz spectrum and is currently investing heavily in developing mmWave terminals to continue to lead the market.