SD-WAN deployment in a large bank

By using its CNM SD-WAN Suite, Teldat has been able to migrate the installed base to SD-WAN technology, implementing the solution in 2,700 customer branches.

Client Summary

The customer is a global financial group with a retail business model and provides a comprehensive range of financial and non-financial products and services to customers around the world. Serving more than 80 million customers globally, it is considered Spain’s second largest bank, supported by its strong presence in Spain and Latin America.

Summary

Challenge

- The customer wanted to migrate to SD-WAN to evolve their network and reduce operational costs.

- The bank needed greater visibility and analytical capabilities over its network.

- Moreover, the solution needed cybersecurity aspects to secure its network.

Solution

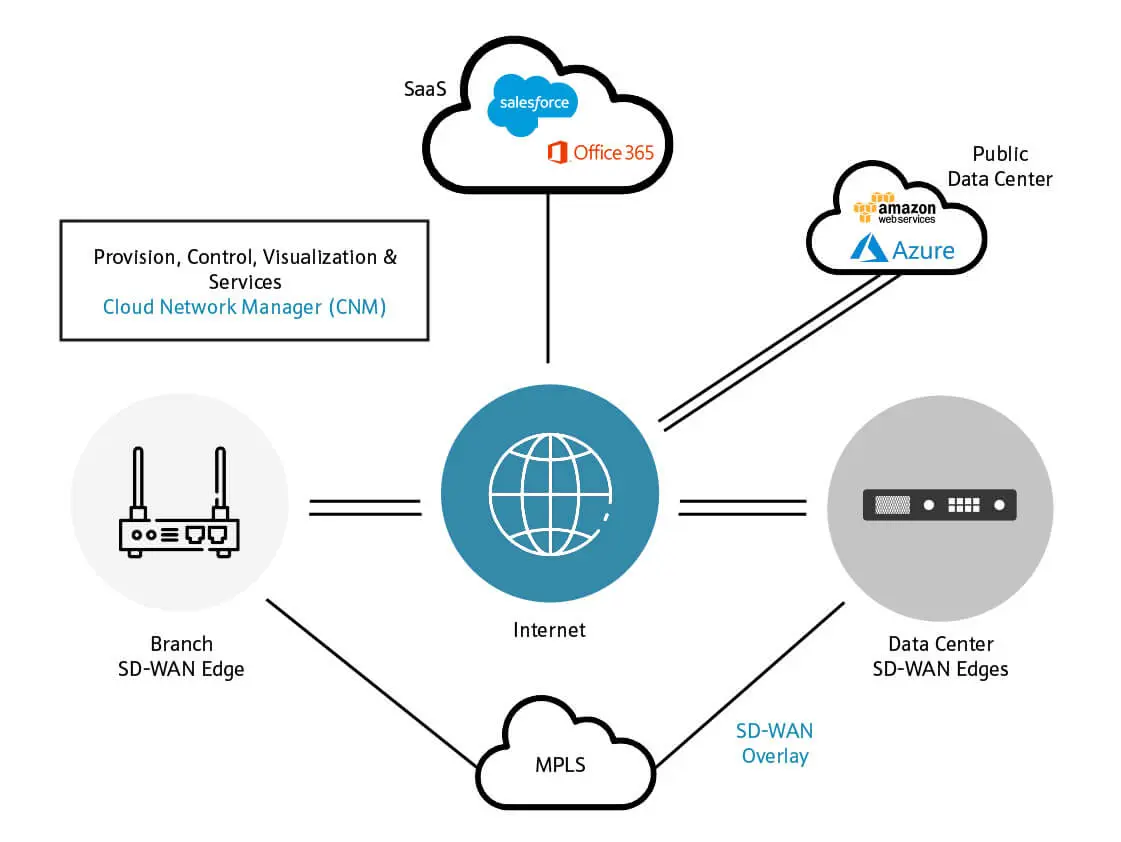

- be.SD-WAN: be.SDWAN is probably the easiest SD-WAN deployment solution available. Users are guided through setting up SD-WAN rules with a GUI assistant to create a secure SD-WAN Overlay, abstracting them from the underlying technology.

- be.Safe XDR: Full visibility of the client network performance, adapted to their business needs.

- be.Safe Pro: Teldat’s Next-Generation Firewall Solution. Whether deployed in offices, datacenter, or the cloud, it protects companies from malware propagation.

Why Teldat?

Teldat’s SD-WAN technology allows the customer to solve all the challenges mentioned above:

- Update the installed base and migrate it to SD-WAN technology.

- Support for multiple WAN lines or MPLS in active-active mode.

- Maintain MPLS infrastructure as backup.

- Reduce costs and achieve very high yields.

- Greater reliability and agility in communications.

- Network visibility at the application level to make it more. efficient and prioritize relevant traffic.

Challenge

The bank, like all others in its sector nowadays, is facing a far-reaching technological and cultural transformation. The banking industry continues to advance swiftly towards a new ecosystem and prioritizes adapting to meet the needs of new “digital” customers. As a result, the customer has undertaken radical organizational and technological change to drive forward a renewal of corporate culture and speed up the transition from an “analog” bank to a knowledge-based service company of the digital age.

One of the most important keys the bank has identified for its digital transformation is that of modernizing its technological infrastructure. The digitalization process of this customer is a process keeping pace with technological advancements and therefore ongoing. In this case, the customer has undergone various phases of technological change related to Teldat.

The customer began by deploying Teldat Atlas-60 devices. By installing this technology, the customer is able to increase the efficiency and comfort of their offices and employees, as well as gain flexibility for two reasons.

First, with high-tech modular equipment in place, it can now be compatible with the many scenarios it faces. Second, the customer currently has an MPLS-based communications network but knows that it will have to migrate its network infrastructure to the cloud in a not-too-distant future. Teldat devices are designed to carry out a gradual migration to SD-WAN scenarios, reusing previously installed hardware.

Consequently, when the company finally needs to implement an SD-WAN solution, as part of its technological development and digital transformation, Teldat will stand out as a strong option to bet on. The reasons for needing to deploy SD-WAN technology in the customer’s network architecture, were (among others) to increase network agility, streamline data management, provide network visibility at the application layer, and reduce the cost of deploying new branches.

Solution

Teldat’s CNM SD-WAN Suite is the best option for a gradual transition from traditional networking to full SD-WAN at the customer’s own pace. It allows the customer to forget about the underlying connection technologies and to control and prioritize data flows in an optimized way. The number of branches to be connected and the number of data centers in use is irrelevant. The modular structure, combined with a thoughtful design, translate into a solution that is, on the one hand, adaptable and, on the other, allows the use of common SD-WAN concepts (on high performance and availability), and at an optimized cost.

The Teldat’s CNM SD-WAN Suite is made up of several modules, of which the bank enjoys the following:

The “Base” module forms the basic framework of the overall solution. It has the possibility of being used individually and operate a network infrastructure with conventional concepts. Mass operations (e.g., software updates, new configurations, etc.) are possible without the need for specialized technicians. The automatic provisioning mechanism allows any number of branch offices to be rolled out quickly, securely and reliably.

The “Controller” module is the orchestrator of the SD-WAN approach used in Teldat’s CNM SD-WAN Suite. This module generates the network abstraction level, the overlay, and it is automatically encrypted and secure, thus reducing complexity while optimizing and controlling data flow, especially at the application level. This ensures that business-critical applications are always delivered with the highest possible performance and, in this case, with the option of using costly MPLS connections when needed, leveraging all the massive management tools provided by the Base.

The «Visualizer» module allows detailed recognition and analysis of the different data flows within the system. It can easily differentiate between services and data flows, even at an application level. Fully customizable dashboards deliver the most in-depth visibility, enabling accurate problem analysis and proactive prevention of emerging sources of error, or the detection of potential internal or external attacks by providing information about traffic (IP address and country of origin).

Results

The customer opted for Teldat’s CNM SD-WAN Suite solution and carried out a migration of its installed base to SD-WAN technology, implementing the solution in 2,700 branches. Now the customer enjoys the best SD-WAN technology but maintains the possibility of automatic backup over the MPLS network. So, despite the SD-WAN migration, the customer still has the option of automatically switching back to MPLS. Thanks to the “Visualizer” module, the customer can obtain network visibility at an application level. Furthermore, the built-in “Controller” module gives them the ability to control the migration of their 2,700 branches to Cloud services. This way communications become more effective and efficient at the same time as the costs of deploying each branch are reduced.

Download Case Study PDF

Explore more Case Studies

A selection of case studies demonstrating how Teldat helps clients around the world, across industries, solve their toughest issues and build long-term value.

Bank need Embedded Applications

Connectivity and remote control for ATMs

Modernizing Bank Branches

Network Traffic Analysis for one of the most important banks in Spain

Reliable LTE migration for an ATM network