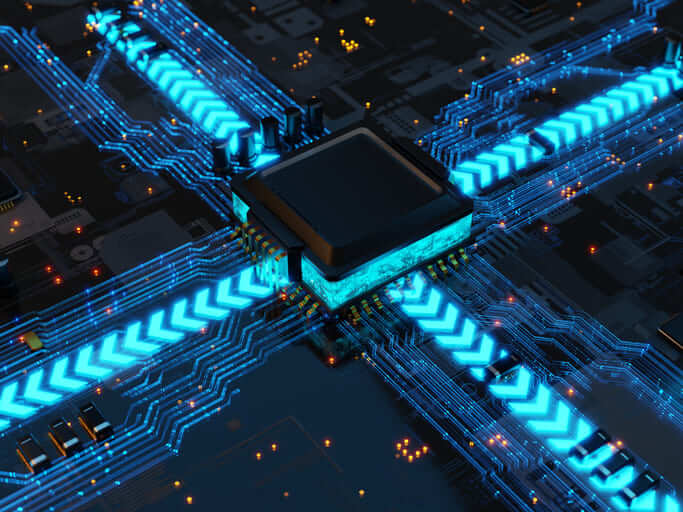

Most of us have likely encountered the term cryptocurrencies, yet not everyone is ready to engage in trading them. In today’s digital era, cryptocurrencies have disrupted the financial scene by providing a decentralized and secure alternative to traditional money. However, this new economic paradigm is not without its challenges and risks. The realms of cybersecurity and cryptocurrencies are closely intertwined, given that the majority operate online and are susceptible to various risks and threats. As a result, ensuring security in the realm of cryptocurrencies has emerged as a paramount concern. This blog post delves into the pivotal aspects of security within the cryptocurrency universe, spanning its history and underlying technology to the challenges and potential threats that users need to remain vigilant about.

Most of us have likely encountered the term cryptocurrencies, yet not everyone is ready to engage in trading them. In today’s digital era, cryptocurrencies have disrupted the financial scene by providing a decentralized and secure alternative to traditional money. However, this new economic paradigm is not without its challenges and risks. The realms of cybersecurity and cryptocurrencies are closely intertwined, given that the majority operate online and are susceptible to various risks and threats. As a result, ensuring security in the realm of cryptocurrencies has emerged as a paramount concern. This blog post delves into the pivotal aspects of security within the cryptocurrency universe, spanning its history and underlying technology to the challenges and potential threats that users need to remain vigilant about.

History of Cryptocurrencies

The advent of Bitcoin in 2009 marked the dawn of cryptocurrencies. Conceived as a peer-to-peer digital currency system, Bitcoin pioneered the introduction of blockchain technology. Since then, thousands of cryptocurrencies have been developed, each boasting its own unique features.

Cryptography, decentralization and blockchain technology serve as the pillars supporting the realm of cryptocurrencies. Cryptography provides a secure foundation for transactions, while decentralization removes the reliance on intermediaries. The blockchain is the robust backbone of cryptocurrencies. This decentralized and distributed ledger meticulously records all transactions in a chronological and secure manner. Each block in the chain comprises a set of transactions cryptographically linked to the preceding block, forming an unalterable and secure chain.

Cryptocurrency Market and Issues

The cryptocurrency market is dynamic and volatile. Investors actively pursue profit opportunities, yet challenges arise due to regulatory gaps and speculative forces. Moreover, addressing concerns surrounding the illicit use of cryptocurrencies and establishing clear regulations are critical issues. For instance, in ransomware attacks, perpetrators encrypt user files and demand a ransom, typically in cryptocurrencies, to unlock them – as payment transactions involving cryptocurrencies are more difficult to trace in many cases.

Digital Cryptocurrency Wallets

The creation of digital wallets stems from the need to offer users a secure platform for storing and managing their cryptocurrencies. These wallets can take the form of software, hardware, or online services, with the latter being the most widely adopted.

- Software Wallets: Installed on devices like computers or mobile phones, these applications grant access to cryptocurrencies stored on the blockchain. They generate private and public keys, streamlining transactions.

- Hardware Wallets: These physical devices are purpose-built to securely store private keys. By maintaining the keys offline, they minimize exposure to cyber threats.

- Online Wallets (Web Wallets): Web-based services that offer users the flexibility to access their cryptocurrencies from any location. While convenient, caution is advised due to the reliance on an internet connection.

Cryptocurrency Mining

Cryptocurrency mining stands as a pivotal element. It involves verifying and recording transactions on the blockchain, earning rewards in the form of the mined currency. Mining pools, often referred to as “pools”, have evolved to address the challenge presented by the rising complexity of individual mining.

- How They Work: Miners join forces to combine their computing power, increasing the likelihood of solving complex mathematical problems that validate transactions. When a group successfully solves a problem, the reward is shared proportionally among the participants.

- Diversification of Computing Power: Mining groups facilitate a fairer distribution of rewards, reducing variability in block acquisition. This accessibility aspect makes mining more feasible for those with limited resources.

- Individual Mining vs. Mining Pools: While individual mining is an option, mining pools offer a more reliable way to secure rewards, especially as mining difficulty increases over time.

Cryptocurrency Security

Cryptocurrency security faces diverse threats, including double-spending attacks, consensus manipulation, and 51% attacks. Scammers also employ phishing schemes to steal private keys.

- Double-Spending Attacks: A double-spending attack occurs when a malicious user tries to spend the same amount of cryptocurrency in two distinct transactions. While this vulnerability is more relevant for low-value transactions, the widespread use of blockchain technology in most cryptocurrencies ensures that once a coin has been spent, it cannot be spent again. This security feature makes it challenging for attackers to exploit this vulnerability.

- 51% Attacks: Within a blockchain network like Bitcoin, 51% attacks happen when a malicious actor gains control of over 50% of the network’s computing power. This enables the attacker to manipulate transactions, reverse blocks, and engage in double spending. However, in networks with a sizeable and decentralized user base, executing these attacks becomes exceedingly difficult. Therefore, it is imperative to exercise caution with new cryptocurrencies, scrutinizing the entities that wield significant control over them.

- Consensus Manipulation Attacks: Some cryptocurrencies employ specific consensus algorithms like Proof of Stake or Proof of Work. Attackers may attempt to manipulate these algorithms to take control of the network. For instance, in the case of Proof of Stake, an attacker would need to own a significant number of coins to influence the network’s decisions.

- Sybil Attacks: Sybil attacks take place when an attacker crafts numerous fake identities or nodes within a network, aiming to gain influence or manipulate information. This type of attack poses a threat to the decentralization of a network by fabricating a deceptive illusion of consensus.

- Phishing and Malware Attacks: Individual users become vulnerable to phishing and malware assaults, where attackers utilize social engineering tactics to deceive and pilfer private keys or login credentials. Additionally, malicious software is distributed to plunder cryptocurrencies stored in users’ digital wallets.

- Exchange Platform Attacks: Cybercriminals find cryptocurrency exchange platforms enticing due to the substantial digital assets they house. Attacks on exchanges can involve intrusions, theft of private keys, and account manipulation. Recently, these attacks have garnered significant attention as some have resulted in the theft of substantial amounts of assets.

- Compute Hijacking: Attacks on assets or websites are frequently observed, with hackers injecting mining code to remotely hijack computing resources. These resources are then pooled to enhance capacity and yield economic gains in mining operations. Any assets published on the Internet are susceptible to this form of exploitation.

Cryptocurrency Exchange Platforms

Numerous attacks have occurred over time, primarily targeting cryptocurrency exchange platforms. Here are some of the most notable ones:

- Gox Attack (2014): Mt. Gox, among the earliest and largest Bitcoin exchange platforms worldwide, fell victim to a massive hack in 2014. This security breach led to the loss of around 850,000 bitcoins, ultimately forcing the platform into bankruptcy.

- Bitfinex Attack (2016): Bitfinex, a leading cryptocurrency exchange, fell victim to a hack that resulted in the loss of around 120,000 bitcoins. In response to this incident, Bitfinex bolstered its security measures and issued debt tokens as compensation for affected users.

- Coincheck Attack (2018): The Japanese exchange platform, Coincheck, suffered a hack that resulted in the loss of around $500 million worth of the NEM cryptocurrency. This event prompted heightened regulatory scrutiny in Japan and emphasized the need for more robust security measures in exchange platforms.

- DeFi bZx Attack (2020): The DeFi (Decentralized Finance) protocol faced several attacks in 2020. Exploiting code vulnerabilities, attackers executed flash loans and manipulated the prices of specific assets. These incidents brought attention to the risks associated with smart contracts and heightened the focus on security within the DeFi space.

- Binance Attack (2022): Among the most notorious incidents, cybercriminals targeted the cryptocurrency exchange platform Binance, making off with 570 million dollars. Exploiting the bridge between BSC Token Hub chains, the hackers created additional Binance coins and pilfered the entirety of available funds.

- Ronin Attack (2022): Marked as the most significant cryptocurrency breach to date, a group of cybercriminals, suspected to be North Korean hackers, infiltrated the Ronin Network exchange platform, specializing in video games. They successfully stole approximately 515 million dollars in stable cryptocurrencies, Ethereum and USDC. The hackers orchestrated the attack by utilizing stolen private keys from owners to withdraw the coins.

The lessons learned from these various attacks have significantly influenced the development of the cryptocurrency ecosystem, fostering advancements in security, and encouraging the adoption of best practices.

How to Use Cryptocurrencies Securely:

- Implement security measures such as utilizing hardware wallets, implementing two-factor authentication (2FA), and staying informed about evolving threats.

- Securely store private keys and avoid sharing them online.

- Use only reliable exchange platforms and wallets.

- Regularly update software, employ effective browsing protections, and maintain robust antivirus measures to protect against potential vulnerabilities and malware

Conclusion on Cryptocurrencies

In our ever more digitally connected world, ensuring security within the realm of cryptocurrencies is of the utmost importance. Safeguarding digital assets demands heightened awareness, continuous education, and the adoption of resilient security practices. This is a collective responsibility, spanning developers, platforms, and individual users.

Vulnerabilities in digital wallets, a lack of awareness regarding security best practices, and exposure to insecure exchanges pose additional risks. Occasionally, we have witnessed the unfortunate loss of private keys, resulting in the permanent loss of digital assets.

While risks do exist, proactive measures can mitigate them. With the implementation of suitable regulations, technological advancements, and a well-informed community, navigating the waters of cryptocurrencies can indeed be an exhilarating and secure journey.

Teldat, a leading provider in the sector, specializes in products designed for the detection and monitoring of network and user activities, exemplified by be.Safe XDR. This advanced solution adeptly monitors both network dynamics and user behavior. Furthermore, Teldat offers be.Safe Pro, allowing the application of sophisticated security policies to remote users and offices. Through thorough traffic analysis, it proactively identifies and neutralizes potential threats before reaching end users.